state bank of india offers car loan for government employees from June 22, 2022. Here you can learn about the interest rate on sbi car loan for govt employees, eligibility criteria of state bank car loan for gov employees.

Are you a Government Employee with regular earnings and planning to buy a new car? Then this article is for you. It contains interest rates of sbi cars loan for govt employees images. Also, check minimum eligibility criteria for govt employees car loan scheme.

If you want to make a good impression on your boss, you are likely to discuss about the benefits of applying for the car loan for government employees. This is a very nice thought. There is no doubt that getting the loan from a reputed bank like SBI corroborates the fact that you are loyal, hardworking employee. What could be better? But this could become even more adorable if you got benefited from the state bank of India car loan interest rate for govt employees 2022. It means that the interest rate has been reduced with an intention to bring more applicants in their radar.

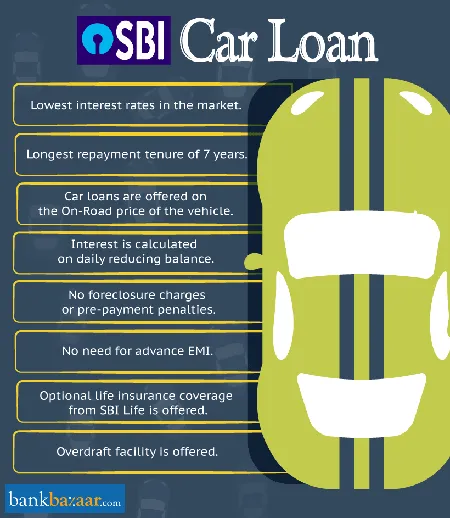

State Bank of India (SBI) offers Car loan at competitive interest rate for both personal and Govt employee applicable only through bank’s website. The car loan from SBI is a quick and easy process, wherein you can get your bad credit Car loan approved within few minutes through the online portal.

Hi, my name is Abe and I’m here to answer your questions about SBI Car Loan.

State Bank of India has been around for a long time, and it shows. They’re considered one of the best banks in the entire country, not just because they date back to the 1800s, but because they’re respected and trusted by Indians.

Get a car loan for government employees – state bank of india

Introduction:

State Bank of India (SBIN) is one of the leading banks in India and provides a wide range of services to government employees. It offers car loans for government employees, which can be a great way for them to get a car without breaking the bank. Plus, it’s easy to apply and you can get a loan quickly.

How to Get a Car Loan for Government Employees.

A car loan for government employees is a type of loan that is available to people working in the United States of America. A car loan for government employees can be borrowed up to a certain amount, and it is generally available in smaller increments than most other types of loans. The car loan for government employees process typically takes about two weeks, and you will need to make an application and meet some specific criteria before being approved for the loan.

How much can you borrow for a car.

The maximum amount that a government employee can borrow on a car loan is $40,000. This limit does not include any federal taxes that may be owed on the purchase of the vehicle. For example, if a person has been employed by the United States military or as part of an intelligence agency, they may be able to borrow up to an additional $60,000 per vehicle. In order to be approved for a car Loan for Government Employees, you must have steady employment with the government and maintain good credit rating. You must also provide proof of insurability (a illness or injury that would prevent you from driving).

What is the Car Loan for Government Employees Process.

When applying for a Car Loan for Government Employees, you will need to complete an application and provide some documentation such as your resume and driver’s license file. After reviewing your application, your lender will likely contact you to schedule a meeting so that you can discuss your financial situation and see how much money you could afford to pay back on your loans over time. Your lender will also want to interview you about your job history and how this affects your ability to pay back loans in full at least every six months.

How to Apply for a Car Loan for Government Employees.

To apply for a car loan for government employees, you will need to complete an application form and provide all necessary information. The application process will vary by bank, but usually it will take around 2-3 weeks to receive a decision.

If you are approved for a car loan, you will be required to pay back the loans in full within a certain period of time. You may also be required to have regular CarFax inspections performed on your vehicle in order to ensure that it is in good condition and meets the requirements set by the lender.

Car Loans for Government Employees.

1.ARM is the most common car loan for government employees.

2. You can get a car loan with a variety of terms and conditions, including ARM.

3. It’s important to read the terms and conditions of your car loan before you make any decisions.

4. If you’re interested in getting a car loan for government employees, be sure to do your research and compare rates before applying.

Conclusion

Government employees can get a car loan for a variety of reasons. The most common is to purchase a car for use in the workplace. However, there are other reasons government employees may need a car. For example, an individual may be assigned to live in a remote location and need a vehicle for transportation. In such cases, the car loan process may be different.