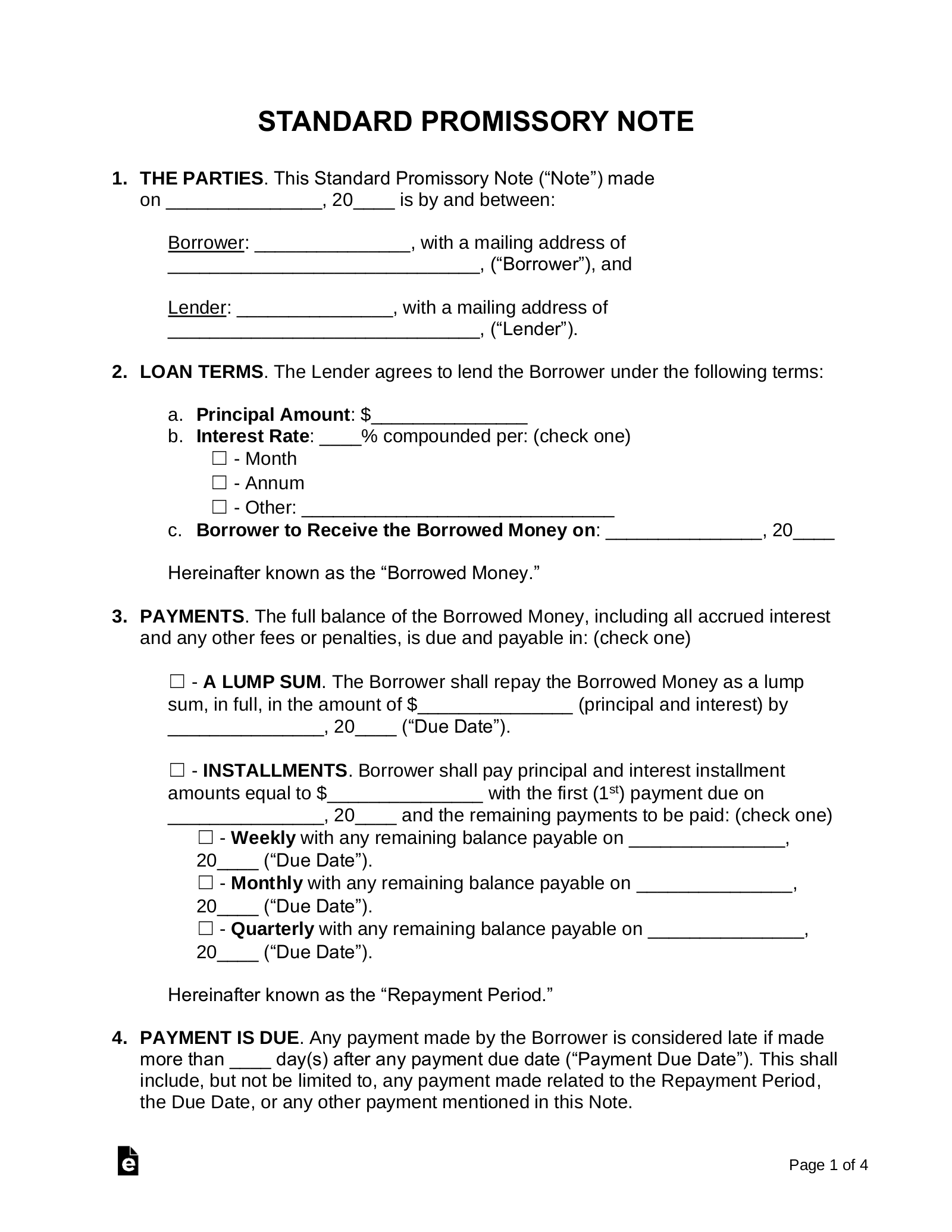

Sample of Promissory Note for loan with duration, interest and penalty

A promissory note is a written promise to pay a specified sum of money, at a specific date or on demand. Promissory notes are used in financial transactions in day-to-day affairs.

Here’s a sample of a promissory note for loan which can be used by anyone who needs help writing up this type of financial document. This document is simply for illustration and not intended for legal purposes.

The promissory note is a special contract of loan between the lender and borrower where the latter undertaking to pay back the amount borrowed in order to discharge the promise. In this agreement, the borrower remains as debtor while being financed by the lender as a creditor. Thus, the two parties will mutually agree upon all important points and conditions needed to be fulfilled. The following sample promissory note for loan will help you define the stipulations for your written loan agreement

A promissory note for loan is a legally binding document that is signed by both the lender and the borrower. The promissory note for loan is mainly used to agree on the repayment of a loan between two parties. It contains details such as the pay back period, interest rate, dates at which interest on credit card debt will be debited, etc. This note can be used by anyone who takes out a loan from someone else either in the form of a mortgage or an auto loan.

As a cash-strapped entrepreneur looking to grow your business and make more sales, you’re always on the lookout for new resources and opportunities that can help you achieve these goals. Here’s where I come in — I’m going to share with you a few of the most important sources of funding once reserved for the rich and famous.

Promissory note for a loan: ASample of Promissory Note for Loan

What is a Promissory Note.

A promissory note is a document that provides money to be paid in the future. A promissory note may be used as a security for a loan, or it may be used to finance other expenses. The purpose of a promissory note is to provide financial assurance that the person will pay back the borrowed money in a timely manner.

What is the Difference between a Promissory Note and a Mortgage.

The difference between a promissory note and an mortgage can be distilled down to two main factors: the amount of money owed on the note and how long it will take for that money to be paid back. Apromissory note usually has anMaturity period of 7-10 years while anmortgage typically has a 30-year term.

What is the Difference Between a Loan and a Mortgage.

There are several other important differences between loans and mortgages, but these are some of the most common:

1) Loans allow you to purchase property, whereas mortgages require you to borrow money against your home equity in order to obtain financing.

2) Loans are easier to pay back, as you can usually make a shorter repayment schedule with a loan than with a mortgage.

3) A mortgage typically requires you to put down a fixed percentage of the value of your home in order to obtain financing, whereas an apromissory note does not typically require this.

How to Make a Promissory Note.

First, you will need to create a promissory note. This document is used to agree to make a loan and to promising future payments. The following steps will help you write a promissory note:

1. Choose the right printer and paper for your note-taking needs.

2. Determine the size of the Promissory Note.

3. Begin writing the text of the Promissory Note.

4. Choose Delivery Date and Time You Will Make Payment on Your Promissory Note.

5. Add any other necessary information (such as signature).

Sign a Promissory Note.

Next, you will need to sign your promissory note! To do this, you will need to have an account with the lender and be able to sign in (or use an electronic signature reader). When signing your promissory note, please remember to:

1) Name the lender and contact information

2) Write clearly and concisely

3) State your intention to pay back the loan on schedule

4) Include payment dates and times for each installment You plan on making

5)state that if there are any changes in your plans, please let us know immediately

6) State that you are aware of the risks associated with this type of loan

7) Make sure to include your driver’s license number and other required information

Notify the Loan Holder of Your Intent to Make a Loan.

Finally, be sure to notify the lender of your intent to make a loan. This will help ensure that you are properly licensed and have all necessary information before making any payments on your promissory note.

How to Make a Payment on a Promissory Note.

When you make a payment on a promissory note, you must pay the interest on the note and also make a payment on the principal of the note. To do this, you will need to find an account with an lender and pay off the entire amount due on the note before it can be converted into cash. To make a payment on the interest on the promissory note, you will need to find an account with an lender that offers interest-bearing loans. You can also make a payment on the principal of the promissory note by writing a check or using money order.

Make a Payment on the Principal of the Promissory Note.

To make a payment on the principle of your promissory note, you will need to find an account with an lender that offers advances for payday loans. A payday loan is a type of loan that is used to meet urgent financial needs such as for groceries, car repairs, or rent. To make a payment on the principle of your promissory note, you will need to find an account with an lender that offers advances for payday loans and write a check or use money order.

Make a Payment On The Date Of The Promissory Note.

If you want to make a payment on yourpromise card or other similar type of promise card, you will need to find an account with an issuer that provides these cards and write or use cash to pay off your debt within set times (usually within 24 hours). This procedure is known as ” payoff.”

Conclusion

Making a Promissory Note is an important step in securing a loan. By signing and notifying the loan holder of your intent to make a loan, you can minimize any potential misunderstandings. Additionally, making a payment on a Promissory Note is an essential part of fulfilling your agreement. Make sure to pay attention to the dates and terms of your Promissory Note so that you are fully repaid as agreed upon.