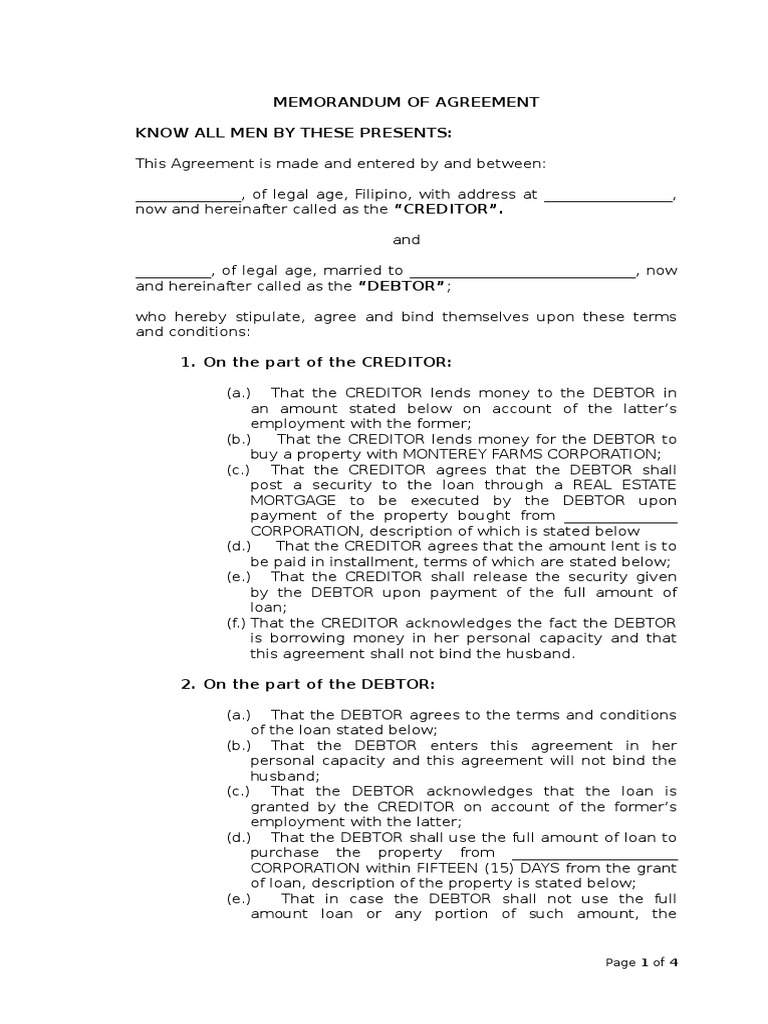

loan agreement between individuals: Personal Loan Agreement Between Individuals – The intent of this page is to provide you with a ready-to-go personal loan agreement template that you can use in drafting your personal loan. Although most contracts are drawn up by an attorney, this loan agreement is a basic outline of the more standard and widely used contract terms used in the industry.

If you are in need of a loan from a friend, here is a template you can use to create your own loan agreement. The memorandum of agreement for your loan includes information regarding the borrower and lender and how the funds will be used.

Friendly Loan Agreement Template a friend and I have borrowed $400 from each other on an indefinite basis. Please review this document to ensure the agreement is clear and correct. This agreement shall remain in effect until the final payment is made or the loan is defaulted upon.

[[Indonesian]] – Agreement between [[two parties]]

While shopping for someone to go in with you on a home purchase,

Loan Agreement For a Small Business: A Sample of What You Can Expect

Introduction: Loan agreements for small businesses can be a daunting task, but we’ve designed this guide to help make the process as smooth and stress-free as possible. In addition to providing a comprehensive overview of the loan agreement process, we’ll also give you tips on how to get the best terms and conditions. Let’s take a closer look!

What is a Loan Agreement.

A loan agreement is a document that sets out the terms and conditions of a loan. The loan agreement can include the terms of the loan, such as the amount of the loan, the repayment schedule, and other important details. In order to qualify for a loan, your business must have a valid business license and meet all other requirements set forth in the Loan Agreement.

Loan Amount.

The maximum amount you can borrow from a lending institution is $250,000. The interest rate on a new loans will be determined by various factors including: your credit score, current debt levels, and projected future income. The interest rate on an existing loans will also be determined by these same factors as well as other factors such as your Business Size and Business Type.

Loan origination and servicer.

Your business must first be registered with one or more lenders before you can apply for a loan from that lender. Your lender will then contact one or more servicers to originate (finance) your loans Must maintain high credit score at all times No interest granted until full payment is received No prepayment penalties allowed

What are the Different Types of Loan Agreements.

A purchase loan is a loan that is given to a new business owner to buy their business. Purchase loans are usually available in smaller denominations than refinance loans, and they can be used to finance a wide variety of purchases, not just new businesses.

Refinance Loans.

A refinancing loan is a loan that is given to an existing business owner to change or update their current debt structure. A refinancing loan usually involves changing the terms of the original debt agreement, which can result in a lower interest rate and more money available for use by the business owner.

Home Equity Loans.

Home equity loans are also called home equity lines of credit (HELOCs). These loans are designed for people who own or have control over their home, rather than just renting it out. They typically have longer term horizons and are often much easier to come by than other types of loans- you don’t need collateral or experience as a business owner in order to get one!

Line of Credit.

Line of credit is another type of loan that can be used by businesses owners for various purposes such as expanding their company or paying off outstanding debts.

Loan Processing and Payment.

When applying for a loan, it’s important to understand the different stages of the loan approval process. The Loan Agreement Sample will outline the steps that will be followed in order for your business to receive a loan.

Loan Payment.

In order to make sure you get a loan, it’s important to have accurate information about your business. This includes understanding the terms of the loan and what needs to be done in order for it to be approved. In addition, remember to keep proper financial records so that you can contact lenders should there be any problems during the repayment process.

Loan Application and Process.

Once you have all of the information needed to apply for a loan, it’s time to start the application process. The Loan Agreement Sample will outline how this process works and what needs to be done in order for your business qualify for an offer of money. Once you have been through the application and payment stages, you should expect to hear back from lenders within 72 hours or less!

Conclusion

Loan agreements are essential components of a business. They provide the foundation for creating a lending relationship with a servicer and allow businesses to borrow money. Different types of loan agreements can be helpful for different businesses. Purchase loans, refinance loans, and line of credit are all common loan agreements. Processing and payment is one important factor in making sure that loans are repaid on time. By understanding how Loan processing and payment work, you can make sure that your loans are processed quickly and easily.