State tax refund status and all the information about how to get it. Fast, easy and free!

I am here to help vanquish the question Where’s My State Refund? I personally waited over 3 months for my state refund and was getting very frustrated. I ended up finding a useful resource that helped me check status of my state refund, avoid many headaches and wasted hours of my life. I have prepared this guide based on my research and experience, hoping it helps you save time and money on your Tax refund.

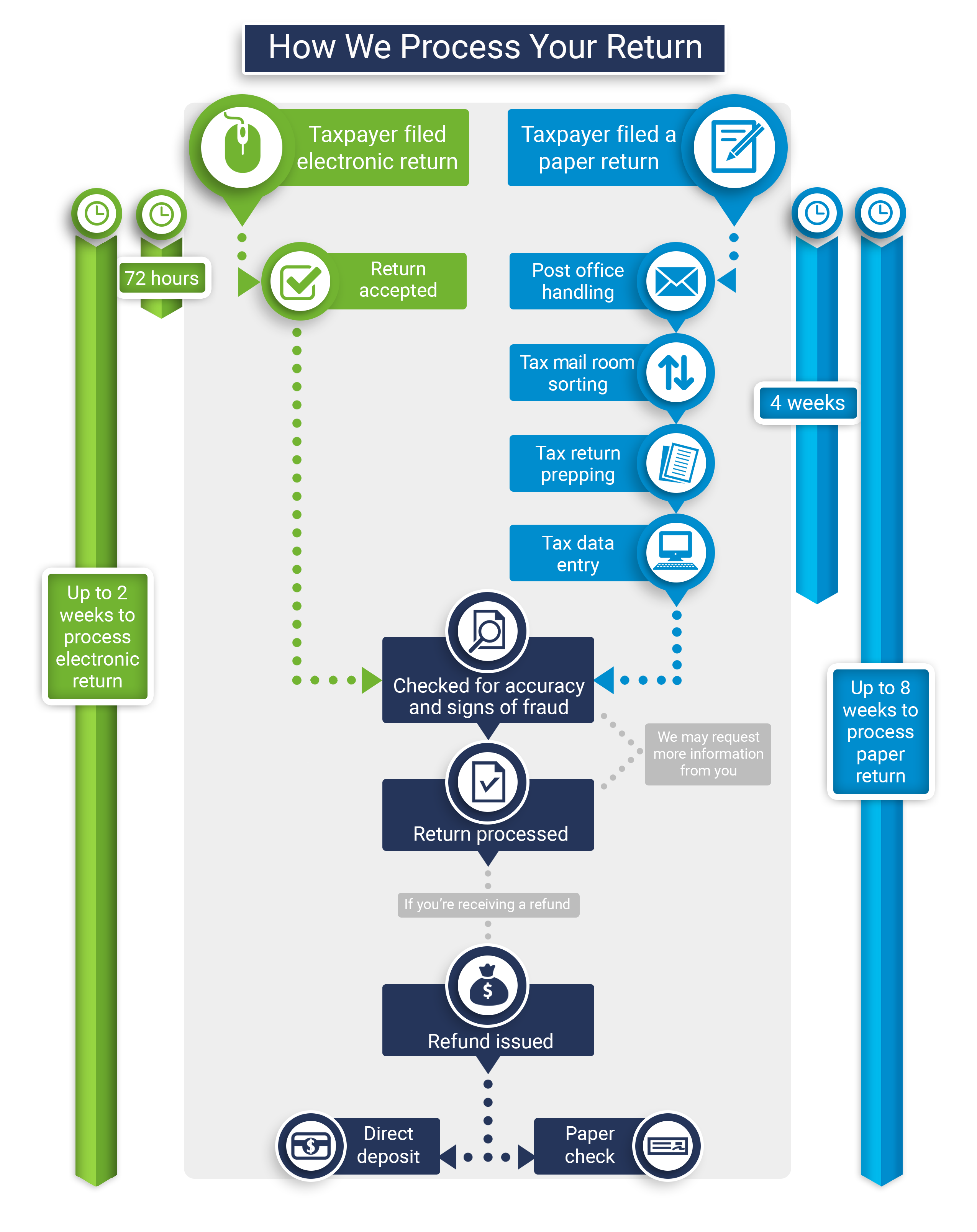

State tax refunds are paid twice annually. IRS places a specific schedule for state tax refunds depending on the state you owe taxes to. About thirteen states run their own websites and efile software for state tax return filing. When you file your taxes with the state, it usually takes 7-10 days for them to process the return and send it to you. Then about 4-6 weeks later, you get the refund check from your local taxing authority’s headquarters. If you have not received your refund check within two months of filing your taxes then this is when you start raising red flags to your State Division of Taxation

Tax season is here, so you may be wondering whether or not you should consider state tax refund loans. State tax refund loans are special forms of short term loans that allow you to borrow the money you need to cover your state tax refund. Here we will discuss how they work, appear and anticipate the collateral claims that can sometimes come as a result of state tax return loans.

I’m getting my state tax refund next week and already thinking about what I can do with it. Are you getting your state tax refund next week too? It’s a good time to think about how you could spend it. I’ve got a few ideas that may inspire you depending on your situation.

If you’re in search of a state tax refund status, it’s possible to find out where your state refund is at. However, it isn’t always easy to find out exactly what’s going on with your state refund in a speedy fashion. Many taxpayers aren’t sure which government agency handles the issuing of these refunds and the process isn’t necessarily straightforward either. If you do discover the right agency to contact, you may be surprised to find that you can’t discuss your private information over the phone , but must submit an inquiry via fax or mail. That’s not exactly convenient.

The Tax Refund Authority: How We Help You Get Your refund

faster

Introduction:

Do you sometimes feel like your refund is slow and drawn out? It can be tough to get a refund in a hurry, and that’s especially true if you’re not used to dealing with the tax system. The Tax Refund Authority can help speed up the process for you! We’ll take care of all the paperwork for you so that you can get your refund faster—no more waiting around for an answer from the IRS. We know how important it is to get your refund—we want to make it as easy as possible for you.

What is the Tax Refund Authority.

The Tax Refund Authority is an online service that helps taxpayers get their refunds. You can use the authority to get a refund by submitting your return online, by phone, or by mail.

We Help You Get Your Refund Online.

You can use the Tax Refund Authority to get your refund online. To do so, you’ll need to provide your federal tax identification number (for returns filed electronically), and enter your information about your return. The Tax Refund Authority will then send you a notification via email about your refund status and how to submit a request for it.

We Help You Get Your Refund By Phone.

You can also use the Tax Refund Authority to get your refund by phone. To do so, you’ll need to provide your federal tax identification number (for returns filed electronically), and call our customer service line at 1-800-829-1040. TheTaxRefundAuthority will then help you with all of the steps needed to receive a refund: from filing your return through to receiving it in the mail!

We Help You Get Your Refund By Mail.

If you’d rather not use the online or telephone methods mentioned above, you can also try getting your refund by mail. To do so, you’ll need to fill out an application form and include all of the information required by the IRS on Form 8473, Request for Refund of Taxes Paid on Qualified Business Income (QBI). You may also need to bring along some supporting documentation like federal income tax returns or proof of business activity!

How to Get Your Tax Refund.

To get your refund, you first need to find the correct system to receive your tax return. To do so, visit the Tax Refund Authority (TRA) website or call their customer service line at 1-800-829-9887. Once you have located the system that will process your tax return, follow these steps:

How to Get Your Refund Online

To get a refund online, you will need to create an account with the TRA and input your taxes and payment information. After clicking on the “Refund Your Tax Return” button, you will be taken to a secure page where you will need to provide your contact information and taxes owed. You will then be able to enter in all of your necessary information and click on the “Refund Your Tax Return” button.

How to Get Your Refund By Phone

To get a refund by phone, you will need to call 1-800-829-9887 and provide all of your information including taxes due and payment method. A representative from the TRA will then be able to help process your refund for you and print out a copy of your tax return for you to keep as evidence. Please note that refunds may only be processed through this method if payment was made in full within 60 days after filing our return online or by calling 1-800-829-9887 during normal business hours; however, some refunds may still be processed through other methods such as check processing or bank transfer if required by law.

How to Get Your Refund By Mail

To receive a refund by mail, you will need to fill out and submit a form titled “Refund Request” at the same time that you file your tax return. Once received, you will be able to print out the form and send it with your payment to the address indicated on the form. Please note that refunds may only be processed through this method if payment was made in full within 60 days after filing our return online or by calling 1-800-829-9887 during normal business hours; however, some refunds may still be processed through other methods such as check processing or bank transfer if required by law.

Tips for Successfully Getting Your Tax Refund.

You’ll need to be prepared for your tax refund if you expect one. Make sure you fill out all of the necessary forms and receive the correct instructions from the Tax Refund Authority before submitting your refund request.

Use our online tools to get your refund.

Use our online tools to get your refund, including our federal form 1040EZ, state form 1040S, or local form 990. We also offer a variety of other helpful resources to help you with your refund quest, including our Tax Refund Guide and How To Get Your Refund.

Use our phone tools to get your refund.

Call us at 1-800-829-9205 or visit one of our branches located around the country to get started on getting your refund. We guarantee that we will walk you through every step of this process and make sure you have everything you need to succeed.

Use our mail tools to get your refund.

Mail is another great way to get your refund – use our mail tools to submit your request and receive a response within a few days or even overnight! By using our mail methods, we can ensure that you have a smooth experience when trying to obtain your tax refunds and that you receive the money you were owed in a timely manner.

Conclusion

The Tax Refund Authority can help you get your refund. Make sure you are prepared for your refund, use our online tools to get your refund, and use our phone and mail services to get your refund. If you have any questions or problems, please contact us. Thank you for reading!